9+ loan x has a principal of $10 000x

Finally it puts all of these concepts together in an extensive case study in Section 11. CFC makes the loan with a principal purpose of avoiding the rules in this paragraph e8.

E Edition Register Star September 17 2021 By Columbia Greene Media Issuu

400x of foreign source passive interest income not subject to foreign withholding tax but subject to Country X income tax of 100x 200x of foreign source passive royalty income subject to a 5 foreign withholding tax foreign tax paid is.

. One comment requested clarification on whether the general rules under section 905c apply to taxpayers who elect to take a deduction rather than a credit for creditable foreign taxes in the prior year to which the. Compensation includes base salary a lucrative commission no capEvernest is looking for a talented Business Development Manager BDM to join our team. Enter the email address you signed up with and well email you a reset link.

BibMe Free Bibliography Citation Maker - MLA APA Chicago Harvard. Balance of p is L 100 p L LE. Deductions for foreign income taxes.

It presents an overview of sensitivity analysis in Section 10. Download Free PDF View PDF. The combined assets of X and B for 2020 averaged under 1861-9Tg3 consist 60 6000x10000x of assets generating domestic source income 30 3000x10000x of assets generating foreign source foreign branch category income.

Next Section 9 discusses cycling in Simplex tableaux and ways to counter this phenomenon. In the general case the amount received from a loan of L with a compensating p L. Then complete the sentence.

Study with Quizlet and memorize flashcards containing terms like 4A. 13 Compute the total cost per year of the following pairs of expenses. On an annual basis the first set of expenses is ______ of the second set of expenses.

Enter the email address you signed up with and well email you a reset link. Income Or Loss Applicable To Common Stock. Volume of old style candy.

Citizen with a tax home in Country X earns the following items of gross income. In Year 1 P a US. Maria spends 20 every week on coffee and spends 130 per month on food 4A.

Bar we reject x 14 and choose x 1. See Part XD3 of the Explanation of Provisions in the 2020 FTC proposed regulations. A registrant has various classes of preferred stock.

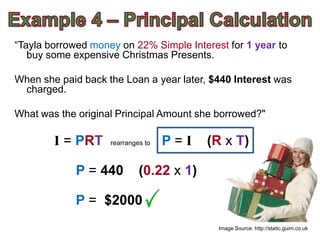

Evernest employees attributed a compensation and benefits rating of 405 stars to their company. If I interest P principal r rate and t time then I Prt. The new bar has length 10 x 10 1 9 cm and width is 5 x 5 1 4 cm.

15 Compute the total cost per year. Income or Loss Applicable to Common Stock S99-5 The following is the text of SAB Topic 6B Accounting Series Release 280General Revision Of Regulation S-X. For example if a company were to become more efficient in inventory management the amount of inventory needed would decline.

Following that link yields the following guidance. The same might be true if the company becomes better at collecting its receivables. Read what they think about their salaries on our Compensation FAQ page for.

Tm2134032d1 Ex99 2img041 Jpg

Basic Simple Interest

Nwh 5 4 2014 By Shaw Media Issuu

Tv497296 Img07 Jpg

2017 Amep Catalog Science And Math By Ck Sales Associates Llc Issuu

E Edition Register Star May 15 16 2021 By Columbia Greene Media Issuu

Personal Loans And Simple Interest Ppt Download

E Edition Register Star April 7 2021 By Columbia Greene Media Issuu

Tm2134032d1 Ex99 2img031 Jpg

Z 20210805

Personal Loans And Simple Interest Ppt Download

Nwh 8 20 2015 By Shaw Media Issuu

Document

Personal Loans And Simple Interest Ppt Download

Times Leader 06 03 2011 By The Wilkes Barre Publishing Company Issuu

D 1 Time Value Of Money Financial Accounting Sixth Edition D Ppt Download

Nwh 8 27 2015 By Shaw Media Issuu